Summarizing the steps before making a decision to 'refinance' a condominium or house in an easily understandable manner within 5 minutes.

Created Jun 12, 2023

Hello dear readers and friends! Today, little Genie has an interesting article for those who are planning to buy a house or for those who already own one and want to familiarize themselves with this term: 'refinancing.' Some of you may already be familiar with this term, but few truly understand its meaning. So today, Genie has gathered information about 'refinancing' for all of you to enjoy. But before we delve into the topic of refinancing, let's get acquainted with 'Fixed Rate' and 'Floating Rate' interest rates for loans.

1. A Fixed Rate is an interest rate set at a specific number that does not fluctuate with the financial institution's costs. Initially, it is usually a short-term interest rate for a period of around 1-5 years, depending on the bank's terms. After that, it switches to a Floating Rate, which means the interest rate changes based on the institution's costs.

2. A Floating Rate is an interest rate that varies according to the financial institution's costs. Simply put, it fluctuates based on the economy during that period. The financial institution announces it periodically. The interest rate that affects Floating Rates is called the Commercial Bank Reference Interest Rate. It typically consists of MLR (Minimum Loan Rate), MOR (Minimum Overdraft Rate), and MRR (Minimum Retail Rate).

- MLR (Minimum Loan Rate) is the interest rate that commercial banks charge their high-profile customers, such as those with good financial history or sufficient collateral. It is mainly used for long-term loans with fixed timeframes, such as business loans.

- MOR (Minimum Overdraft Rate) is the interest rate that commercial banks charge their high-profile customers for overdrafts on their accounts. The interest is calculated only on the amount that exceeds the funds in the account.

- MRR (Minimum Retail Rate) is the interest rate that commercial banks charge their retail customers, such as personal loans or residential mortgages.

Today, let's talk about the topic of 'refinancing,' specifically for residential mortgages. When it comes to refinancing, we need to calculate and observe the Minimum Retail Rate (MRR). It's important to note that the MRR can vary among different banks. Generally, you can check it at the bank's branch or their website. You can also find this information on the website of the Bank of Thailand. Now, without further delay, let's explore the concept of refinancing together!

Refinancing, whether for condos or houses, refers to applying for a new loan from a different bank to repay the existing debt. After that, the borrower repays the new loan at a lower interest rate. However, there is a condition that the borrower must complete the original contract with the original bank, which is typically around 3 years.

In simpler terms, refinancing means changing to a new lender who offers better terms than the original lender. This could include reducing the interest rate, fees, or other expenses.

Refinancing can be done for various types of loans, such as home loans, condo loans, or car loans. However, it is most commonly used for home and condo loans, as it often provides significantly lower interest rates.

The advantages of refinancing:

As mentioned earlier, refinancing allows you to obtain a lower interest rate, resulting in reduced monthly payments and overall interest costs. Simply put, the amount you pay towards the principal increases because the interest rate is lower than before.

To get a clearer picture, let's consider the following example:

Miss Jai Di applied for a loan to purchase a condo worth 3 million baht from a bank for a term of 30 years or a total of 360 installments. The monthly installment was set at 15,000 baht, and the Monthly Reference Rate (MRR) was 7%. The bank initially set the interest rate for the first three years at 3.3%, and from the fourth year onwards, it was MRR-2.0%.

"The calculation of interest is done by multiplying the principal amount by the interest rate and the number of days in the given month, divided by the total number of days in a year."

In the first installment, Miss Jai Di would have to pay (3,000,000 x 3.3% x 31) / 365 = 8,408.22 baht in interest.

However, since Miss Jai Di chose to pay 15,000 baht per month, her principal payment for the first installment would be 15,000 - 8,408.22 = 6,591.78 baht.

This means that her remaining principal would be 3,000,000 - 6,591.78 = 2,993,408.22 baht.

In summary, if Miss Jai Di pays 15,000 baht per month for the condo, approximately 6,591.78 baht would go towards the principal in each installment.

After completing the three-year contract, Miss Jai Di will have two options:

1. Continue paying with the original bank and its existing conditions.

2. Refinance with a new bank and new conditions.

If Miss Jai Di chooses option 1 to continue paying with the original bank and its existing conditions, we can provide an example as follows:

After making 36 installments or 3 years of payments, Miss Jai Di still owes a remaining principal of 2,700,000 baht to the original bank. In the fourth year, with the interest rate at MRR-2.0%, the interest would be 5%.

In the 37th installment, Miss Jai Di would have to pay (2,700,000 x 5% x 31) / 365 = 11,465.75 baht in interest.

However, since Miss Jai Di continues to pay 15,000 baht per month, her principal payment would only be 3,534.25 baht.

Therefore, in the following month, the remaining principal for Miss Jai Di would be 2,700,000 - 3,534.25 = 2,696,465.75 baht.

If Miss Jai Di chooses option 2 to refinance with a new bank and its new conditions, we can provide an example as follows:

If Miss Jai Di decides to refinance with a new bank, she would receive another promotional interest rate reduction. For example, the new bank offers an MRR of 6.75% with an average interest rate set at 3.8% for the first 3 years, and then MRR - 0.25% for the subsequent years.

Miss Jai Di applies for refinancing with a loan amount of 2,700,000 baht. The interest payment for the first installment would be (2,700,000 x 3.8% x 31) / 365 = 8,713.97 baht.

However, since Miss Jai Di continues to pay 15,000 baht per month, her principal payment would be 6,286.03 baht.

Therefore, in the following month, the remaining principal for Miss Jai Di would be 2,700,000 - 6,286.03 = 2,693,713.97 baht.

How does that sound? Refinancing provides clear benefits as we can see the distinct difference. If we don't refinance, we would have to pay higher interest rates, and it would take longer to pay off the debt. However, along with the benefits, there are also drawbacks.

Disadvantages of refinancing:

Before making a decision to apply for refinancing, I would like everyone to consider whether the interest rate we would receive justifies the process of moving to a new contract. Refinancing is similar to buying a new house because it requires time and preparation. There are also various expenses involved. If we roughly calculate the costs and find that the difference in interest rates is only 0.25%, it may not be worth the time and effort spent on dealing with all the documents.

The documents that need to be prepared before submitting a 'refinance' application.

As mentioned above, "refinancing" can be likened to buying a condominium or a new house. Therefore, the bank needs to verify our identity to ensure that we meet the required criteria. Generally, the documents that need to be prepared can be divided into three categories:

1. Personal Information Documents:

These documents are required for the bank to verify and confirm our identity as genuine borrowers. They include:

1. Copy of identification card

2. Copy of house registration

3. Copy of name change certificate (if applicable)

4. Copies of identification card and house registration of spouse (if applicable)

5. Copies of marriage certificate/divorce certificate (if applicable)

6. Copies of death certificate and marriage registration of deceased spouse (in case of deceased spouse)

If there are co-borrowers, the same set of documents should be prepared for them as well.

2. Income Documents:

These documents are requested by the bank to assess our repayment capacity and review our past banking history. They can be categorized as follows:

2.1. Regular Income Individuals:

2.1.1. Payslips for the past three months or employment certification

2.1.2. Bank statements for the past six months

2.1.3.Proof of entitlement to social welfare benefits (if applicable)

2.1.4. Withholding tax certificates (50 Tav) from the employer (for selected banks)

2.2. Self-Employed Individuals:

2.2.1. Copy of business registration certificate

2.2.2. List of shareholders' accounts with the borrower's name

2.2.3. Bank statements for the past 12 months (personal and business)

2.2.4. PND 30 form (if applicable) or PND 50/51 for the past five months (if applicable)

If there are co-borrowers, the same set of income documents should be prepared for them as well.

It's important to note that different banks may require different income documents. Some banks may request bank statements for up to 12 months.

3. Collateral Documents:

These documents serve to confirm ownership of the collateral that will be used for refinancing. They include documents from the original bank and the Department of Land, such as:

1. Copies of title deed or condominium ownership certificate (Chor Nor. Sor. 3 or Condo Juristic Person Registration)

2. Copies of land sale agreement (Tor Dor. 13) or condominium purchase agreement

3. Copies of land mortgage agreement or condominium mortgage agreement

4. Copies of loan agreement with the original financial institution

5. Copies of installment payment receipts for the house or 12-month transaction history if the installments are automatically deducted

It can be seen that the process of preparing documents for refinancing is similar to applying for a new home loan. The above-mentioned list of documents is just a basic guideline, and some banks may require additional documents.

Refinancing expenses.

For the next topic, let's look at the most important thing, which is "expenses." Before we decide to "refinance," we need to know how to calculate the expenses and what costs are involved. Today, Genie has gathered the information for you to calculate. We can divide the expenses into two main parts as follows:

1. Expenses incurred by the bank:

- Property appraisal fees:

This depends on the service area and the location of the collateral. Generally, it ranges from 2,000 to 3,000 Baht. However, each bank may have different prices. This expense involves sending someone to evaluate the current value of the property so that the bank can assess the loan amount based on the collateral value.

- MRTA Insurance fees (Mortgage Life Insurance):

Note that this expense is optional. You can choose whether to take this insurance or not. Many people may already have this insurance from their previous bank, and you can transfer the rights to the new bank. Alternatively, you can choose to purchase this insurance from other providers.

- Other fees:

This depends on the bank and may or may not be applicable.

2. Expenses required by law:

- Mortgage registration fees:

For mortgage registration fees, you need to prepare money to pay the Land Department, which is 1% of the remaining loan amount from the previous bank. Some banks offer promotions of "free mortgage registration" (but you still need to pay the amount upfront, and the bank will refund it within approximately 30-45 days). For example:

If the remaining loan amount from the previous bank is 2,000,000 Baht, we need to pay the mortgage registration fee: 2,000,000 x 1% = 20,000 Baht.

- Stamp duty fees:

This is calculated as 0.05% of the loan amount, with a maximum of 10,000 Baht. It can be easily calculated as 500 Baht per million Baht.

- Fire insurance fees:

This is mandatory insurance that borrowers of condominiums need to have throughout the loan term. The cost depends on the policy, and Genie recommends choosing coverage of at least 70%.

Wow, in addition to preparing various documents, we also need to calculate the expenses for refinancing. Genie suggests that you calculate the expenses in detail, including factors such as future interest rate trends because the MRR (Minimum Retail Rate) fluctuates and adjusts over time according to interest rate policies. Once you and your friends have calculated the expenses thoroughly, let's take a closer look at the steps for applying for refinancing."

Please note that I have tried my best to provide an accurate translation, but some meanings may vary depending on the context.

Steps for Refinancing:

1. Review the original loan agreement:

Before everyone proceeds with refinancing the condominium, it's necessary to review the original loan agreement to determine if it has reached the refinancing period. Generally, banks set the refinancing period at 3-5 years.

It is recommended to start the refinancing process at least 1-2 months before the completion of the 3-year installment period. This is because the bank's various processes, including assessment, appraisal, and loan approval, may take a considerable amount of time.

2. Select the right bank for refinancing:

As mentioned earlier, in selecting a new bank for refinancing, it's essential to study the interest rates and compare different promotions offered by each bank. This will help ensure that you receive the best possible benefits since banks often entice customers with attractive promotions.

3. Prepare the necessary documents:

In this step, you need to gather personal documents, financial documents, and the documents related to the property you want to refinance (the condominium). For detailed information about the required documents, please refer to the previous sections.

4.Calculate the costs of refinancing:

While refinancing can save interest expenses significantly, it's important to consider the associated fees. The costs may include:

- Appraisal fees (some banks may offer free appraisals)

- Mortgage fees (1% of the loan amount; some banks may offer waived mortgage fees)

- Stamp duty fees (0.05% of the loan amount)

- Other bank fees, such as loan processing fees

Additionally, mortgage fire insurance is required and should be paid every 1-3 years, regardless of refinancing.

5. Submit the refinancing application to the new bank:

Once you have prepared all the necessary documents and calculated the costs, you can submit the application to the new bank. If all documents are complete and meet the requirements, the bank will send an appraiser to assess the collateral value. The bank will then take approximately 2-4 weeks to evaluate the application.

6. Inquire about the outstanding debt and schedule the handover date with the old bank:

After receiving approval from the new bank, you should inquire about the outstanding debt and schedule a handover date with the old bank. This is to ensure that both banks can transfer the funds accurately and appropriately to settle the debt.

7. Sign the contract and register the mortgage with the land department:

Once both banks have cleared the outstanding debt, you need to sign the contract and register the mortgage with the land department. For convenience, it's possible to complete both steps on the same day.

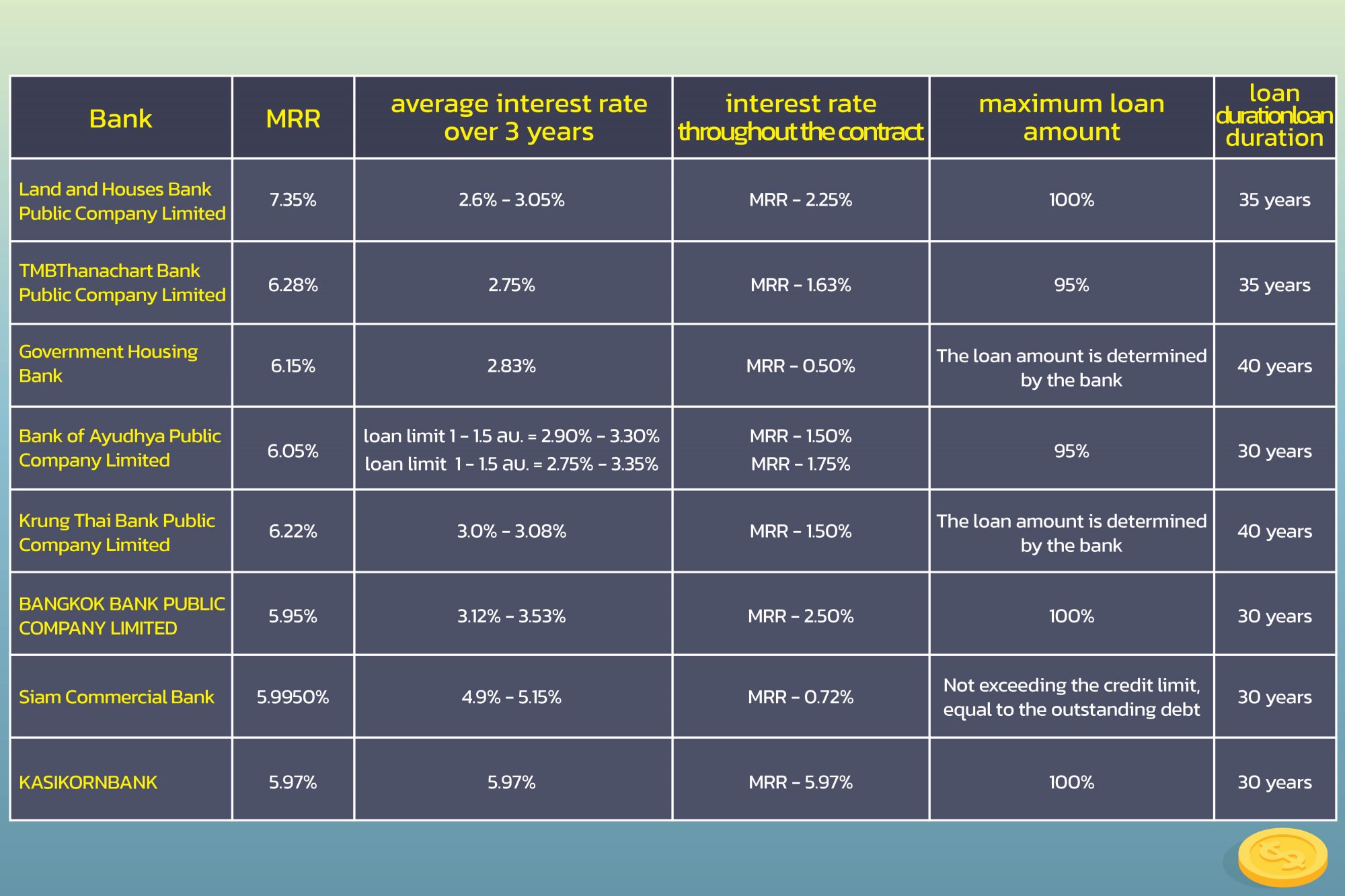

Updated Refinancing Interest Rates Table for Each Bank as of March 2565:

How about discussing the steps for applying for a "condo or house refinance" that we're sharing today? Personally, Genie believes that refinancing should be done every 3 years to reduce our expenses. However, as mentioned, it is important to carefully calculate the costs. Otherwise, if we refinance but end up saving only a few thousand baht in interest, it might not be worth it considering the fees and paperwork involved in the process. Also, remember that the offered MRR interest rate can fluctuate over time based on the economic situation. So, be prepared to handle this aspect as well. Genie hopes that this article can provide everyone with a better understanding of the refinancing process.

You can follow Genie's works, articles, and content related to lifestyle and real estate on:

Facebook: Genie-Property.com

Website: Genie-Property.com

Thank you for the information provided by

Krungsri

Refinn

MoneyBuffalo