LGBTQ+ couples can now co-own?

Created Jun 16, 2023

Currently, Thai society has become more open-minded regarding alternative genders, even extending to the realm of home loan applications. There are several banks that offer opportunities for LGBTQ+ couples to apply for joint loans together. Today, Genie has provided the details for you to explore and understand the necessary steps. You can also find information about which banks provide these loans in this article. Let's take a look!

1. Why do we need to apply for a joint loan?

First of all, I would like to clarify that if we want to purchase a house, it is important to have a sufficient income and stable employment. Otherwise, the chances of loan approval are very low. That's why many people nowadays seek co-borrowers to fulfill this requirement.

A joint loan refers to signing a loan agreement together for the same property. The co-borrower must be a spouse, parent, sibling, or relative. Simply put, they must be related by blood or have a familial relationship.

The bank determines the number of co-borrowers allowed. For example, it can be up to three individuals. The bank's approval of the loan depends on evaluating the income of each person to assess their monthly repayment capacity, in addition to the loan amount requested.

2. Answering the question, "Why can't LGBTQ+ couples apply for joint loans?

As mentioned by Genie earlier, if we want to apply for a joint loan, the person who wants to apply with us must be a blood relative or a registered spouse - either legally married or in a domestic partnership. However, even if they are not legally married, they need to provide evidence of being in a committed relationship, such as wedding photos, for example.

For LGBTQ+ couples, the reason they cannot apply for joint loans is primarily because they are unable to register their relationships legally to demonstrate their commitment in terms of marriage or domestic partnership.

However, some banks have recognized the needs of LGBTQ+ couples and have started offering joint loans with similar conditions to those available for heterosexual couples who are not legally married. This means there needs to be confirmation of the relationship according to the criteria set by the bank.

Please note that the translation aims to convey the meaning in an easy-to-understand manner while preserving the essence of the original text.

3. Regarding the differences between general joint loans and LGBTQ+ joint loans

For the general joint loans and LGBTQ+ joint loans, the majority of the process is the same. The main difference lies in the ownership aspect, as explained by Genie in two different types:

Type 1: Applying for a joint loan with only one person as the owner of the rights.

Type 2: Applying for a joint loan with both individuals named as co-owners of the rights.

However, for LGBTQ+ couples, most banks will typically offer the option of joint ownership of the rights.

Please note that the translation aims to convey the meaning in a native-like manner while ensuring easy understanding for the reader.

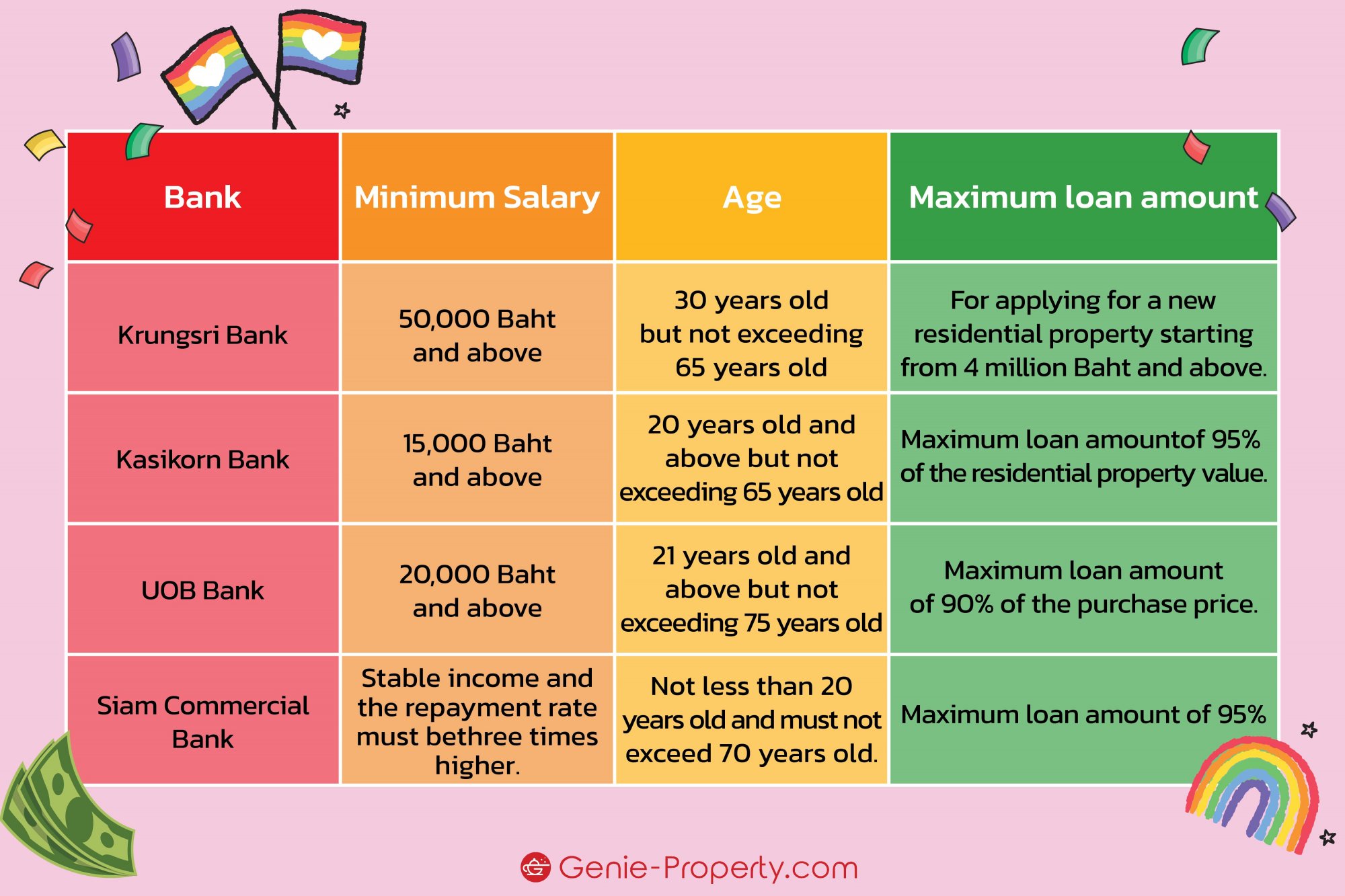

4. Four Banks that Allow LGBTQ+ Couples to Apply for Joint Loans

As mentioned earlier by Genie, there are now several banks that recognize the importance of housing for LGBTQ+ couples. They are pleased to approve joint loan applications for them. However, the conditions and terms for granting the loans may vary. Let's take a look at which banks offer these loans and what their specific conditions are."

Please note that the translation aims to convey the meaning in a native-like manner while ensuring easy understanding for the reader.

1. Krungthai Bank

Joint Home Loan Application for Couples

A joint home loan application for couples who wish to live together differs from the traditional joint loan in that it does not require a family relationship between the borrowers. Instead, it considers the income, repayment potential, and creditworthiness of both borrowers. Additionally, a verification process is conducted to confirm the relationship. The main borrower and co-borrower must meet the following criteria:

- Ordinary individual

- Thai nationality

- Age 30-65 years old

- Employed with a minimum work experience of 2 years (including the current job, which must have passed the probation period)

- Self-employed with a business history of at least 2 years

- The main borrower must have a monthly income of at least 50,000 Baht

- The borrowers must provide documents or evidence of their relationship or cohabitation for at least 1 year, as specified by the bank, such as jointly registered address or joint bank account. For further information, you can inquire with a sales representative.

Participation Requirements:

-The loan is for purchasing a new residential property from projects under the partnership of Krungthai Bank at the purchase price (after deducting all discounts) of 4 million Baht and above.

- The interest rate is based on the respective groups as announced by the bank.

- Loan approval is subject to the criteria and conditions set by the bank.

Required Documents for Loan Application:

- Copy of identification card

- Copy of household registration

- Copy of name change certificate (if applicable)

- Copy of professional license held for at least 2 years and still valid, for special occupations (if applicable)

- Income certification letter and salary slips

- 6-month bank statements

- Copy of purchase agreement

2. Kasikorn Bank

Kasikorn Bank requires applicants, including LGBTQ+ couples, who want to apply for a home loan to clearly indicate in the loan application form their "relationship as a couple" with the main borrower. The following qualifications must be met:

Qualifications:

- Thai nationality, aged 20 years and above, but not exceeding 70 years old

- The co-borrowers must not exceed 3 persons and must be relatives according to the law (including unregistered spouses)

Income:

- In the case of a single borrower, a net income of at least 15,000 Baht per month

- In the case of joint borrowers, a combined net income of at least 15,000 Baht per month

Note:

- In the case of purchasing assets awaiting sale, the minimum net income is 7,500 Baht per month (the combined net income of all borrowers in a joint loan must meet the above criteria).

- Employment duration must be at least 6 months (including the previous employment, subject to a probation period at the current job).

Participation Requirements:

- Maximum loan amount is 100% of the property value.

- Maximum loan repayment period is 30 years.

Required Documents for Loan Application:

- Copy of identification card

- Copy of household registration

- Certification of cohabitation

- Copy of name change certificate (if applicable)

- Income certification letter and salary slips

- 6-month bank statements

- Copy of purchase agreement

- In the case of joint borrowers, a combined net income of at least 15,000 Baht per month is required.

3. UOB Bank

UOB Bank offers personal loans similar to general personal loans, not exclusively for the LGBTQ+ community. The eligibility criteria for UOB Bank are as follows:

Eligibility:

- Thai nationality and a regular citizen

- Minimum age of 21 years, including the loan tenure

- Minimum employment tenure of 2 years (or 3 years for self-employed/business owners)

- For salaried individuals and government agencies, the age limit is 70 years

- For business owners, the age limit is 75 years

Income:

- Main borrower and co-borrower must have a monthly income of at least 20,000 baht

Participation Conditions:

- Maximum loan amount of 100% of the purchase price

- Maximum repayment period of 30 years

Required Documents for Loan Application:

- Copy of ID card

- Copy of house registration

- Co-habitation certificate

- Copy of name change document (if applicable)

- Salary certification and payslips

- 6-month bank statements

- Purchase agreement copy

4. SCB Bank

For SCB Bank, you can apply for joint loans under similar considerations as with other loan applications. The basic eligibility criteria for SCB Bank are as follows:

Eligibility:

- Thai nationality

- Minimum age of 20 years, with a maximum loan tenure of the borrower not exceeding 65 years (considering the youngest borrower's age)

- No previous restructuring of debts from financial institutions

Income:

- The bank does not specify a particular income requirement, but you need to have a stable income that is at least three times the installment amount.

Participation Conditions:

- Maximum loan amount of 95% of the residential property value

Required Documents for Loan Application:

- Copy of ID card or government officer card or state enterprise employee card with national ID number and a photo on the card, or passport copy (for foreign spouses) along with a copy of the house registration

- Copy of house registration

- Copy of marriage certificate (if applicable)

- Copy of name change document (if applicable)

- Copy of purchase agreement

- Salary certification and payslips

- 6-month bank statements

5. Joint Loan Issues: If there is a cancellation of the joint loan agreement

While many people see joint loans as a solution for home purchases, there is another issue that we should be aware of. If one day both borrowers are no longer together, what are the ways to resolve these problems? Today, Genie has some advice for you.

1. Withdrawing Joint Borrower's Name in the Case of Unregistered Marriage

For withdrawing the joint borrower's name in the case of an unregistered marriage, it is not difficult, depending on the agreement between both parties. You can proceed with the matter by contacting the bank where the joint loan agreement was made. You can express your intention to hold sole ownership rights because you have separated but not registered your marriage. In the next step, the bank officials will assess the ability of the remaining borrower to continue repaying the loan.

2. Withdrawing Joint Borrower's Name in the Case of Registered Marriage

For withdrawing the joint borrower's name in the case of a registered marriage, the process is slightly different. After completing negotiations and signing the divorce agreement, the party who agrees to continue repaying the loan needs to provide the bank with a copy of the divorce certificate and the purchase and sale agreement. You can inform the bank of your intention to remove the name of the former partner from the joint loan agreement. The bank officials will then change the loan structure and issue a new loan agreement.

3. Refinancing from Joint Loan to Individual Loan

For those who have already applied to withdraw the name of their partner but are unable to do so because the bank has determined that the remaining borrower cannot repay the remaining debt alone, refinancing with the bank is another option. You can apply for an individual loan for the residential property. The bank will then assess your ability to repay the debt based on the following criteria:

3.1. Borrower's income

3.2. Down payment for the house

3.3. Borrower's monthly debt burden

3.4. Credit history or blacklist record

4. Selling the House and Dividing Assets Equally

For couples who no longer want the aforementioned house, selling the house and dividing the assets equally is the best option. Before selling the house, it is necessary to inspect its condition and settle various fees, including:

4.1. Transfer fees

4.2. Stamp duty

4.3. Withholding tax

4.4. Specific business tax

Regarding joint loans for LGBTQ+ couples, Genie acknowledges that Thailand has become more open to diverse sexual orientations, leading to an increased desire to create families, including the aspiration for a "home." However, joint home loans for LGBTQ+ couples are still challenging due to the lack of legal recognition of same-sex marriages in Thailand. Nevertheless, several banks have started approving loans that cater to the needs of the LGBTQ+ community and even offer special promotions.

Genie hopes that this article will provide knowledge and assist friends in making decisions regarding home purchases, to some extent. It is especially beneficial to make the decision to buy a house within this year since the Thai government has implemented measures to stimulate the real estate market in 2022. Don't miss out on this great opportunity!

You can stay updated and show support to our team of writers by liking our Facebook Fanpage or contacting us through LINE, email, or our website:

LINE: @genie-property.com

FACEBOOK: Genie-Property.com

EMAIL: sales@genie-property.com

CALL CENTER: 093-232-9888, 064-931-8666

Website: www.genie-property.com